Cybersecurity Tips for Fintech Apps

Privacy and security are imperative in keeping your personal information safe on your mobile device — especially when using fintech apps to manage your finances. Almost all fintech apps have access to information that could personally identify you, which is why it’s important to be diligent about your data and protect your dollars. Here are a few important tips to keep in mind when using fintech apps.

1. Don’t skip the terms and conditions

When you download a fintech app, users are usually required to review and accept the terms and conditions that apply to app usage. While these terms and conditions can be long winded and difficult to understand, it’s worth spending some time reading into how the app protects your privacy, which of your information the app will access, and how that information will be stored and shared.

2. Be diligent about password protection

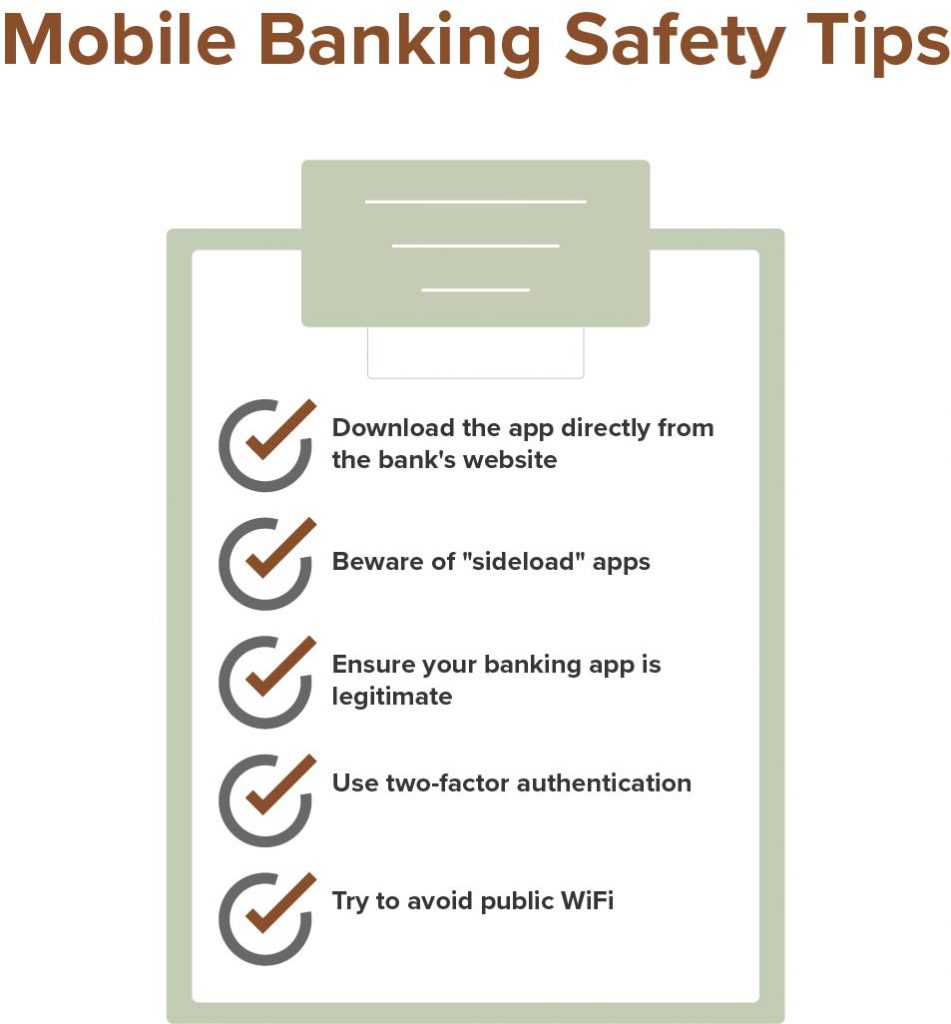

It’s not enough to keep your fintech app password protected. Passwords for fintech apps should not only be unique and difficult to guess, but they should also be changed regularly to make gaining access to your accounts more challenging and protect against potential threats. Whenever possible, enable two-factor authentication for fintech apps and use security measures on your device, such as fingerprint, facial ID, or password login to protect your data.

3. Do your research before downloading a fintech app

Fintech apps make managing finances through a mobile device easy and exciting. However, before downloading a new fintech app, take the time to learn more about it. For example, some fintech apps charge a monthly fee to use — whether it’s a transaction fee for sending money or a fee to access financial advisors on a budgeting app. There are many fintech apps on the market, so shop around before choosing which one you’ll use for mobile payments, budgeting, and banking.

4. Monitor for issues and know how to resolve them

If you do notice anything on your device that raises red flags, address the issue swiftly. Keep customer service information for your fintech apps in an easily accessible place, and be sure to call and report suspicious activity as soon as you notice it.

Cybersecurity Resources

Live Chat

Live Chat